Legacy Title Company Blog

Commercial Snapshot Q1 2025

Commercial Market Snapshot Q1 2025

March 5, 2025

MARKET OVERVIEW

The fourth quarter of 2024 marked a return to positive and broad Commercial Real Estate (CRE) deal growth after two years of declines. Federal Reserve rate reductions and a "developer in chief" as president-elect helped bolster December transactions to their highest for that month in three years.

This activity may have energized price discovery and sector differentiation. December prices ticked down after four months of gains. Cap rates for Office and Retail rose slightly since Q3, while high quality Multifamily assets experienced compression, CoStar data showed. Distress deals were insignificant, although delinquencies crept up for all but Industrial in Q4.

Uncertainty has tempered transaction activity so far this quarter, fueled by a jump in treasury yields1, the legality and volume of executive orders from the White House, an unwelcomed blip in January inflation, fluctuating tariff policies and the market-altering aftermath of fires in Los Angeles. Despite a bumpy start to a new CRE cycle, Bisnow reports anticipated price discovery momentum and continued engagement by banks. The Mortgage Bankers Association expects 2025 originations to expand by 16%. “Given the strong pickup in origination activity at the end of 2024, it appears that at least some borrowers and lenders are ready to move.”

So far, declining deliveries have boosted the fundamentals in all major sectors, per CoStar. In Retail, 2024 net deliveries2 were vastly below their 10-year average, holding vacancy2 at 4.1% in January. JLL believes that the hits Industrial took to vacancy and rents from its surge in space are near the end. In Q4, Office saw vacancy2 stabilize at 13.8%, the pace of downsizing decline and net absorption go positive for the first time in three years. However, there is a lot of transition left for the Office sector. The federal government’s aggressive return-to-work policy will lead to rightsizing in many markets. The pace of Multifamily deliveries2 is expected to ease further in 2025. And with current mortgage rates at their highest in over six months, the rent vs. buy decision strongly favors renting. Consequently, Fannie Mae foresees rental growth doubling this year.

A DEEPER DIVE: HIGH QUALITY, LARGE MULTIFAMILY DEVELOPMENTS

According to CoStar, Multifamily transactions leapt almost 22% in 2024, making it investors’ target asset class for this year. Four- and five-star properties with 50 units or more are particularly in demand. The graph below shows which regions were ahead of the declining deliveries curve but had keen investor activity – making them worthy of attention early in 2025.

This is the case in the Southeast, particularly the central Florida and Atlanta markets, which experienced both a steep growth in sales and the sharpest drop in deliveries over 2024. FOMO (Fear Of Missing Out) might drive very energetic activity here. On the other hand, besides Chicago, many of the markets in the Midwest region had neither transaction momentum nor much change in inventory. Investors are expected to be selective and let price discovery play out in these markets. The Northeast, West, Southwest and Mid-Atlantic regions all either saw sizeable declines in inventory – or enjoyed the uplift in transactions over the year. These regions may enjoy healthy activity in Q1, but not at a frantic pace.

WHAT’S NEXT?

Stay tuned for next month’s Economic Update Q1 2025 to see how the commercial real estate market finishes the first quarter of 2025 and where it could be headed next.

1 Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, February 26, 2025.

2 Copyright ©2025 “January 2025 Commercial Real Estate Insights.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. https://www.nar.realtor/commercial-real-estate-market-insights/january-2025-commercial-real-estate-market-insights

How Hybrid Work is Changing the Office Sector

How Hybrid Work is Changing the Office Sector

By 2025, hybrid work is projected to be the dominant work model for many companies across the nation. With over one billion square feet of office space available for lease, and approximately 150 million square feet of leased space set to expire in 2025, CRE investors are faced with increased pressure to attract and retain tenants. In this blog, we’ll explore how this shift is altering the way tenants view office space and how CRE investors can adapt to meet the evolving demands of hybrid work models.

In August this year, ResumeBuilder.com conducted a survey of 764 companies that transitioned to a fully remote work model at the onset of the COVID-19 pandemic. According to the results, the companies’ return-to-office (RTO) plans presented the following:

- 64% have a policy that requires some or all employees to work from the office at least part-time.

- 23% plan to implement such a policy by the end of 2025.

- 7% plan to implement such a policy in 2026 or later.

- Roughly 6% of the companies do not have such a policy in place.

- 30% of the companies are requiring employees to return to the office full-time.

- A majority of the companies are operating with a hybrid work model.

As companies continue to prioritize employee satisfaction and wellness initiatives as key retention and recruitment strategies for top talent, hybrid work models have become a popular option in RTO policies, since they offer flexibility while also maintaining in-person collaboration. Some of the top companies leading the way in successful hybrid work models include Amazon, Google and Airbnb. For a list of the top 13 companies reported by OfficeSpace, along with details about how these companies executed their work plans, click here.

According to Cushman & Wakefield’s Office Fit Cost Guide, the cost of redesigning office space differs by location, mainly due to the varied cost of materials and labor. For instance, the average fit out price per square foot in Atlanta is $159; for Chicago, $173; for L.A., $178; for New York, $213; and for San Francisco, $223. For CRE investors and property managers to make informed investment and operating decisions, they’ll need to evaluate the needs of their tenants, focusing on occupancy rates, space utilization and tenant feedback. Keeping an eye on the cost of fit outs and current trends can help investors make knowledgeable decisions about their portfolios and investments.

Current Design Trends

Traditional office space is becoming increasingly obsolete. Fixed locations with designated desks and meeting rooms are transforming into hybrid models that allow employees to work from home while still having access to a physical office with a welcoming, well designed and technically optimized environment for collaboration and meetings when needed. Essential office designs for hybrid work models generally include, but are not limited to, the following:

• Hot-desking. Flexible workspace arrangements where employees don’t have assigned desks and use available space at any time. The space is utilized on a first-come, first-served basis, or by reservation.

• Task-zones. Activity-based work (ABW) zones that allow employees to be more productive in fulfilling a specific need or task. Some examples include collaboration zones for group work, brainstorming and discussions; quiet zones for focused and individual work; and private zones designated for personal breaks.

• Office pods. An office pod is a soundproofed and mobile room that can be used as a private space for employees. They come in a variety of sizes, from smaller phone-booth-like pods for individuals to larger ones that supplement traditional meeting rooms. A recent cost study found that utilizing office pods instead of building new meeting rooms can significantly lower costs, with estimates suggesting potential savings of over $30 billion between 2023 and 2030.

• Work cafés. Open café workspaces have steadily gained popularity over the past decade. Taking cues from coffee shops, these spaces offer coffee, teas and small lounge areas or tall tabletops for employees to work over a cup of coffee or connect with a colleague. According to research, these in-person social encounters can help promote teamwork, generate ideas and foster emotional connections that support employee wellbeing.

• Health and wellness spaces. Office space that is centered around health and wellness remains a popular trend. Enhanced indoor air quality and biophilic design that connects tenants to nature by incorporating plants, natural light and water elements are top design elements. Dedicated fitness areas, walking paths and wellness rooms designed to reduce stress and boost morale are also popular. These amenities help to promote a healthy lifestyle and improve cognitive performance.

• Eco-friendly practices. Tenants are increasingly prioritizing eco-friendly practices, like energy-efficient systems, sustainable materials and green certifications. This shift not only helps reduce environmental impact but also enhances property value. It can also help CRE investors and property managers realize cost savings through incentives and lower operating expenses.

• Technology integration. Secure digital infrastructure, cutting-edge video conferencing features, and dependable, fast internet are essential for hybrid work. Tenants in a hybrid work model are likely to be drawn to properties that have pre-wired, high-tech areas designed for high-quality audio and video conferencing, wireless screen sharing and the ability to utilize other collaborative tools.

The integration of smart technology and artificial intelligence (AI) in office space will continue to revolutionize the way people work. Smart technology, such as IoT devices like automated lighting and climate control systems, also creates more efficient and responsive environments. AI-driven tools enhance productivity by automating routine tasks and providing data-driven insights for better decision-making.

Conclusion

The Office sector is in a period of ongoing transition as hybrid work shifts to the new norm. Although there are unique challenges to navigate, CRE investors can still find ways to maximize existing portfolios and find new investment opportunities in certain corners of the market. Savvy CRE investors may wish to conduct market research, utilize a due diligence checklist and have a clear understanding of the shift in office trends before making any investment decisions.

At Old Republic Title, we remain committed to supporting CRE investors and property managers as they transition their office spaces from traditional to hybrid work models and realign their office portfolios. Our National Commercial Services team is here to provide customized commercial services whether your project is simple or complex. To learn more about our services and to connect with a team near you, visit oldrepublictitle.com/commercial/ncs/.

Commercial Snapshot Q4 2024

Commercial Market Snapshot Q4 2024

December 4, 2024

MARKET OVERVIEW

The third quarter’s performance was better than expected and market sentiment continued to climb in the fourth along with broad deal activity. There was general optimism over the return of a “business-friendly” administration to the White House, but there was caution as the industry wondered when Commercial Real Estate (CRE) interest rates would also become friendlier.

Optimism spurred by the .5% interest rate drop by the Federal Reserve (the Fed) in September pushed transaction volume to $68B in Q3, according to CoStar. This activity was off only 18.1% on an annual basis and an advancement of 10.5% from Q2. Also, year-to-date, 12-month rolling sales volume was slightly ahead of 2023. Transactions in Q4 were boosted by investors getting into the market ahead of a full rebound. Indeed, Costar reported that prices picked up for the third month in a row in October and cap rates may be compressing. While Office slightly pulled down the overall Q3 delinquency figure and distress deals rose in September, troubled properties have yet to play a big role.

The four major asset types all saw stronger deal activity in Q3, reflecting stabilizing fundamentals. According to JLL, Industrial has normalized; although vacancy ticked up again, rental rates remain the most attractive of all major asset classes at 3%. Retail rent growth was the strongest since 2008, and the holiday season heralds more in-store shopping and higher spending. Per the National Association of REALTORS®, Multifamily net absorption1 was again over 100% and the vacancy rate crept down. Even the concerned outlook for Office has tempered as net absorption1 became positive in Q3 for the first time in eight quarters.

The Fed’s rate cuts totaled .75% through November, but commercial rates have yet to follow. The 5-2, 7-3 and 10-year4 Treasury rates (which drive commercial rates) were all at least 75 basis points higher in mid-November than in September – a market signal that rates will be higher for longer due to president-elect Trump’s policies.

Trump’s stated goals include cutting corporate taxes – which may foster a larger government deficit while boosting the economy – as well as increasing tariffs broadly, but these factors could relight inflation. For CRE, the new plans may be both dampening and supportive.

For example, CHiPs and IRA allocations, which boosted Industrial development, may be slowed. But onerous tariffs could prompt more onshoring. An emphasis on reducing corporate burdens may inform upcoming debates on capital gains and 1031 exchanges, carried interest breaks and environmental standards. For right now, despite the unknowns, positivity is in the air.

A DEEPER DIVE: DATA CENTERS

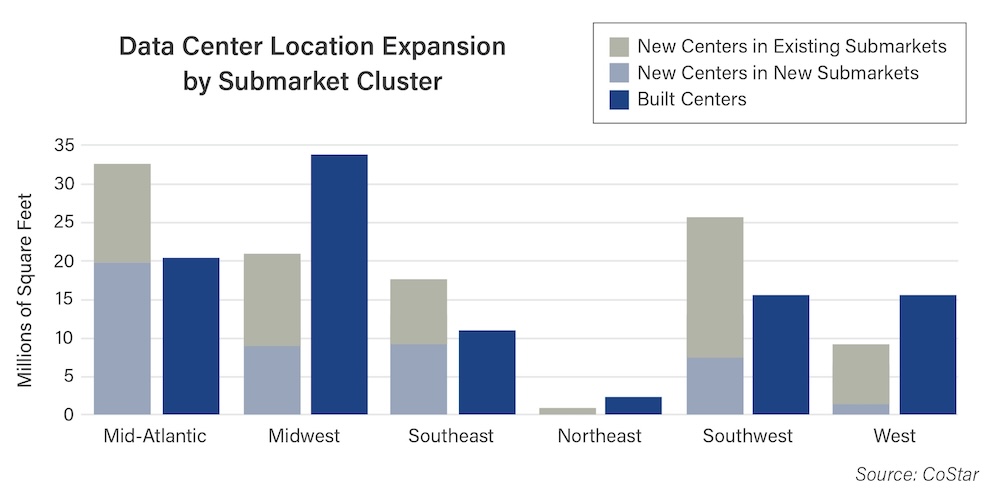

For the past year, headlines about Artificial Intelligence (AI), and by extension, data center development, were unavoidable and optimistic. Of late, the costs of data center energy and water usage have come under scrutiny, particularly in some of the largest markets: Virginia, Texas and Georgia. Thus, growth may be easier in new markets.

The chart below details data center placement. New centers in new submarkets could become future clusters. For example, Virginia, which is already the dominant data center cluster in the U.S., will have the most expansion of a new computing footprint. But over half of the additional square footage will be an Amazon facility in Fredericksburg (about two hours south of Washington D.C.). In the West, while few new markets are in development, it is notable that Colorado and Indiana are getting data centers, albeit smaller ones, for the first time. In the Southwest and the Southeast, new construction will more than double the current situation. An Amazon building outside of Jackson, Mississippi, may bring more emphasis there. The Austin, Texas area will remain one of the top places for data centers, although smaller expansions are happening farther afield in Temple and Abilene.

WHAT’S NEXT?

Stay tuned for next month’s Economic Update Q4 2024 to see how the year ends and what 2025 could have in store for commercial real estate.

1 Copyright© 2024 “October 2024 Commercial Real Estate Market Insights.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. November 2024, https://cms.nar.realtor/sites/default/files/2024-11/2024-10-commercial-real-estate-market-insights-report-11-07-2024.pdf

2 Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis [DGS5], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS5, December 2, 2024.

3 Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 7-Year Constant Maturity, Quoted on an Investment Basis [DGS7], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS7, December 2, 2024.

4 Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, December 2, 2024.

10 Easy Tips to Create a Healthier Home

10 Easy Tips to Create a Healthier Home

Creating a healthier home is a vital step to enhancing your overall well-being. Your living environment can impact your physical health, mental clarity and emotional balance. By focusing on improving air quality and reducing exposure to harmful chemicals, you can transform your home into a healthy sanctuary. In this blog, we’ve compiled 10 easy tips to help you create a healthier home environment.

1. Take your shoes off at the door. According to a recent study by microbiologist Dr. Charles Gerba, the sole of a single shoe has an average of 421,000 units of bacteria. Removing your shoes at the front door is an easy way to keep your floors free of bacteria, chemicals and other hazardous substances that could be lingering on the soles of shoes.

2. Incorporate potted plants. Potted plants are often used to add color and texture to a room, but they also come with great health benefits. During photosynthesis, plants convert the carbon dioxide we exhale into fresh oxygen and remove toxins from the air. Potted plants not only help purify the air, but also provide allergy relief, improve sleep quality and reduce stress levels. According to a study conducted by NASA, some of the top purifying plants include the spider plant, peace lily, snake plant and bamboo palm.

3. Vacuum, sweep, mop and dust regularly. Dust mites and pet dander can trigger respiratory and dermatological conditions including asthma and eczema. Set a routine cleaning schedule to prevent buildup and ensure consistency.

4. Consider an air purifier. Improve the air quality in your home with an air purifier. Doing so can help fight against air pollutants, including mold spores and pesticides, and reduce your risk of developing respiratory illnesses. For guidance from ENERGY STAR® about how to pick the right air purifier for your home, click here.

5. Avoid using cleaners with dangerous chemicals. A clean home contributes to a healthy lifestyle. However, some cleaning products contain toxic substances that can be detrimental to your health. Some harmful ingredients to look out for include:

- Phthalates

- Parabens

- 2-butoxyethanol

- Formaldehyde

- Sodium hydroxide

- Quaternary Ammonium Compounds

- Linear Alkylbenzene Sulfonates

- Phenols

For a list of products that offer safer ingredients, click here.

6. Schedule an annual chimney sweep. A dirty chimney contains high levels of creosote, soot, ash and dangerous gases, such as carbon monoxide, that can pose a risk to your health if inhaled. It can cause headaches, eye and skin irritations and difficulty breathing. For tips on how to reduce air pollutants while burning wood, click here.

7. Change your HVAC filters often. Several factors account for how often you should change your filter, such as the age of the HVAC system, the type of filter used, if you live in a dry climate, and whether or not you have pets. According to ENERGY STAR, you should check the air filter on your central air conditioner, furnace or heat pump once a month. Most HVAC companies and air filter manufacturers recommend changing the filter every three months.

8. Invest in water filters. A 2023 study conducted by the United States Geological Survey (USGS) found that at least 45% of the nation’s tap water could contain one or more types of harmful chemicals known as Per- and Polyfluorinated Substances (PFAS). A water filtration system or individual sink filters can help remove unwanted impurities, leaving you and your family with a healthier water supply.

9. Beware of mold. Mold growth can occur due to moisture/condensation, poor ventilation and water leaks. If left untreated, it can lead to health concerns, from allergic reactions and respiratory complications to lung infections and neurological effects. Mold can also cause unsightly stains and structural damage that could decrease the value of your property. Conducting regular mold inspections using an at-home kit or the help of a professional can help keep you and your family safe and avoid costly repairs. For more information on mold, its effects and guidance for addressing mold issues in your home, click here.

10. Let the outside air in. Studies conducted by the EPA found that air pollutants are often two to five times higher indoors than outdoors. Opening windows and doors to allow fresh air in can help reduce your exposure to indoor pollutants, cleanse your lungs, improve heart and brain health, and elevate your overall mood.

Incorporating healthier habits in your home is an easy way to enhance your quality of life. Making mindful choices to improve indoor air quality and avoid toxic cleaning products can help create a space that supports both physical and mental well-being. Start today to watch your home transform into a heathier environment for you and your family!

7 Reasons Homeowners Need Title Insurance

7 Reasons Homeowners Need Title Insurance

Purchasing a house is a momentous occasion and likely one of the biggest purchases you’ll ever make. Such an investment requires proper protection, especially considering it’s the very place you and your family call home. One way to protect your property with title insurance. Here are seven reasons why title insurance is vital for homeowners’ financial security.

WHAT IS TITLE INSURANCE?

First, let’s review what title insurance does. A title is the evidence of ownership and possession of property, which stands against the right of anyone else to claim it. Title insurance is a means of protection against financial loss, should any title defects or third-party claims arise from your title.

There are two types of title insurance policies:

1. An owner's title insurance policy is a policy of indemnity and protects the homebuyer’s property rights against covered claims that may surface after purchase. While not required, it is always in your best interest to purchase an owner’s title insurance policy.

2. A loan policy (or lender’s policy) insures the financial investment of the lender or bank, and is typically required to get a mortgage loan.

REASONS TO PURCHASE TITLE INSURANCE

1. A THOROUGH TITLE SEARCH

Before you commit to buying or refinancing property, a title examiner will examine title plants or public record databases to determine ownership of the property and to uncover deeds, mortgages, wills, divorce decrees, court judgments, tax records, liens, encumbrances, bail bonds and maps associated with the property. This search is designed to disclose any potential title defects or legal issues ahead of time.

2. PROTECTION FROM UNFORESEEN DEFECTS

Even after the most exhaustive title search, there is still a chance that unforeseen title defects could surface long after you’ve purchased your new property. Title insurance protects the policyholder from undisclosed:

• Liens that are the result of a prior owner’s actions, which can be placed against the property by a contractor, tax authority or lender who hasn’t been paid.

• Easements or a third party’s right to use or access your property, even though you are the owner. Say a utility or sewer line runs through your backyard. If so, the utility or sanitation company has an easement allowing them to access your property. That easement could also prohibit you from using your property however you want, such as building a garage or adding a pool.

• Encumbrances or other forms of claims against the property, which can include restrictive covenants imposed by homeowners’ associations or leaseholder rights.

• Outstanding debt from the previous owner, such as mortgages, judgments, unpaid child support or unpaid taxes.

• Conflicting wills or an undisclosed/unknown heir of a previous owner suddenly claiming ownership.

3. PROTECTION FROM UNFORESEEN RISKS OR CLAIMS

If the previous record owner was deceitful, or an error was made in any documents, title insurance will protect you from certain covered risks, not exceeding the amount of the insurance policy, including a defect in title caused by things like:

• Forgery of documents

• Fraud or impersonation of the property’s true owners

• Clerical errors that result in a document not being properly filed, recorded, or indexed in the public records.

4. PROTECTION IN COURT

Should a covered defect in your property’s title or a claim arise, your title insurance underwriter will protect your financial interests, including defend you in court and settle any covered claims for you.

5. A LOW ONE-TIME PAYMENT

Unlike most insurance policies that have monthly premiums, owner’s title insurance requires a one-time fee at closing. This one-time fee typically accounts for about 1% of the purchase price and protects you from covered risks for as long as you or your heirs own the property. Check out Old Republic Title’s Rate Calculator to find rates in your area.

6. DIFFERENT FROM HOMEOWNER’S INSURANCE

While often confused, title insurance is not the same as homeowner’s insurance. The latter protects the property structure and your belongings, while title insurance protects your right of ownership to the property.

7. PEACE OF MIND

Title problems (“defects”) are relatively common. While most of them can be fixed, you can’t fix something that is unknown. Chains of title can go back hundreds of years, during which time documents can be lost, destroyed or never filed. Title defects that come to light after the transaction can threaten property rights and create costly title disputes without the security of title insurance.

If buying or refinancing a home is on the horizon for you, purchasing title insurance should be, too! Fees vary by state, so contact your local Old Republic Title representative for more information.